SaaSletter - Coatue EMW 2024 + Avenir

Quick takes from two great decks

“Avenir x SaaS: What’s Gone Wrong In Software And Why We’re Optimistic” - these 45-slides from Jared Sleeper, Hannah Bao, and David Prilutsky will definitely be included in our 2H 2024 update of our best business of software content curation.

Their primary research (n = 75 enterprise buyers) yielded some interesting findings, such as the AI native vs incumbent question. Survey result excerpts below:

Their analysis of the increasing proportion of capital entering “hard” categories - like Developer Tools and Cybersecurity - is an interesting indicator of software’s maturation:

Regarding their call for more software companies to “get fit”…

a number of software companies will be unable to “get fit”:

My contribution = Morgan Stanley’s “SaaS X-Ray” framework calculates pro forma operating margins at a steady state growth rate of 10%. Their April 2024 X-ray report shows that ~20% of *public companies* are unable to generate margins above 10% at maturity.

Again, this is for public companies, which are the “best of the best.” The proportion of private companies unable to generate meaningful cash flow while growing—a key indicator of being “fit”—is surely higher.

Why are terminal operating margins low? Our own regressions of MS’ X-Ray data set show current Sales & Marketing margins are by far the #1 predictor of steady state margins.

With S&M as the largest P&L line item, business logic supports these regression findings. My take: S&M challenges are a by-product of a) crowded categories (see my “State of The Industry” slides at Bowery Capital’s AGM), b) the realities that marginal, later-adopting customers have higher CACs, and c) that sustained low-cost CAC sources (word of mouth / *real* PLG, oligopoly style market structures) that offset marginal customer CAC inflation are exceedingly rare (i.e. for a handful of top public companies).

Jumping back to their slides, Avenir called out excessive stock-based compensation:

… and included Thoma Bravo’s margin chart…

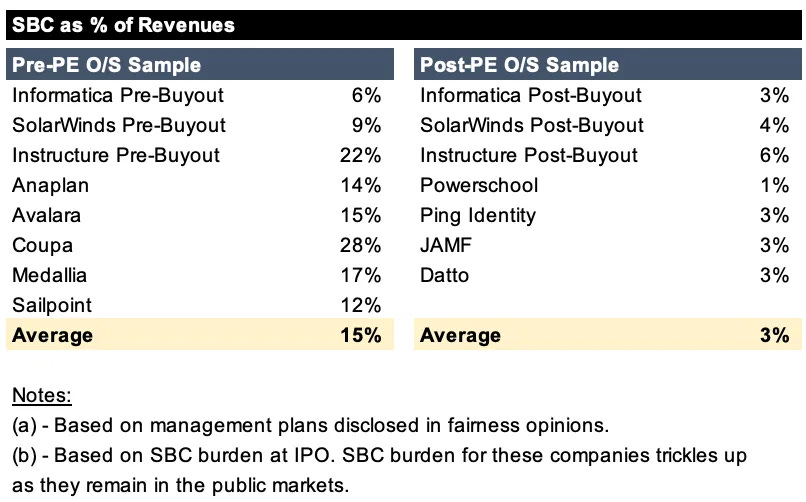

… which merits flagging Tidal Wave’s “Private Equity's SBC Opportunity”case studies on stock based compensation levels under private equity - PE ownership does constrain SBC dilution:

Again, go read the full Avenir slide deck.

Coatue EMW 2024

The video (which shows slides, but no deck directly available) of the ever popular “Coatue View on the State of the Markets” is here.

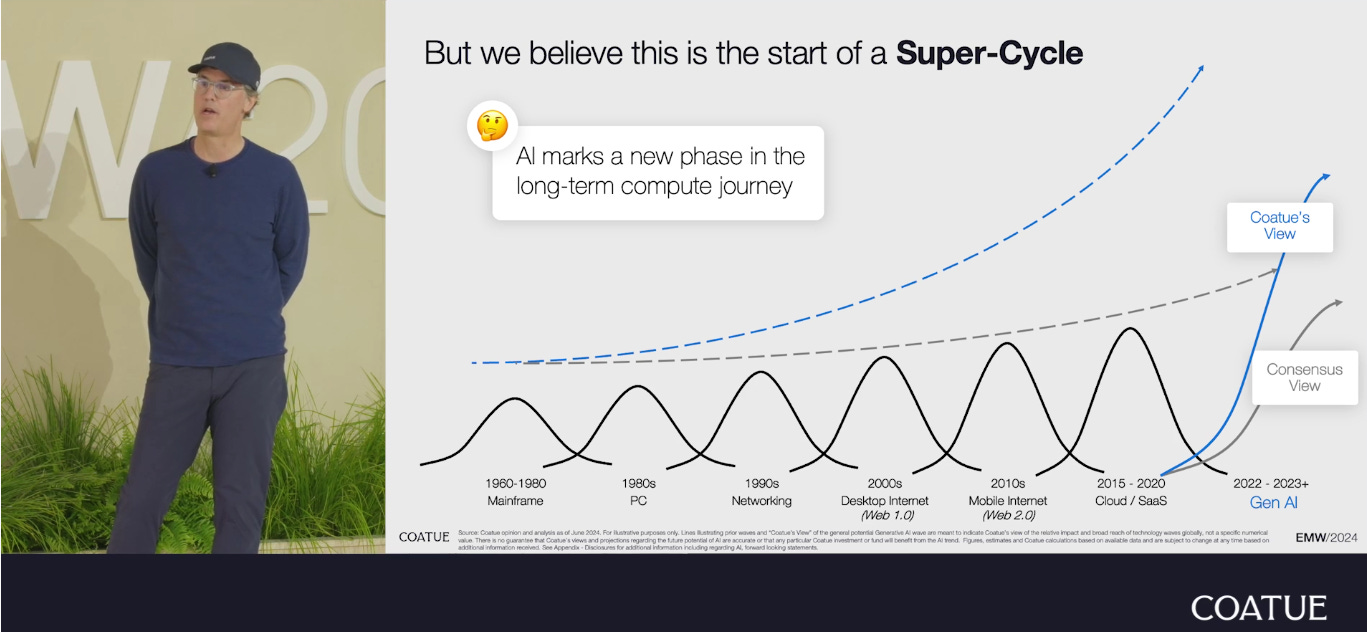

Especially in light of the recent “AI Bubble Math” discussions, I found Coatue’s *above consensus view on AI* to be the most important slide:

Readers of this newsletter will enjoy their discussion of “Is Software Dead?” (loyal readers know I particularly appreciated the inclusion of value-based pricing → more here) …

… while the second half of EMW 2024 focused more on the capital markets (i.e. why there are few IPOs). Go watch the full Coatue EMW 2024 talk here.

Curated Content

“The path from zero to IPO: Revisiting the Mendoza line in 2024” - Eduard Danalache at Scale Venture Partners. Includes an interactive calculator and shows how the bar for growth has gone up in SaaS.

Capital Market Provider Survey

A past podcast guest of ours - Brian Parks of BigFoot Capital - is conducting a survey for their annual Capital Provider Market Sentiment Survey (last year slides here).

Investors + Lenders: Take ~3 minutes to submit to their 2024 survey here.

About Cloud Ratings

In case you missed it, we recently announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants, this newsletter, our podcasts, and our True ROI practice area all fit within our modern analyst firm: