SaaSletter - April 2023 SaaS Demand Index

Plus indicators from Gartner, RepVue, and Scale Venture Partners

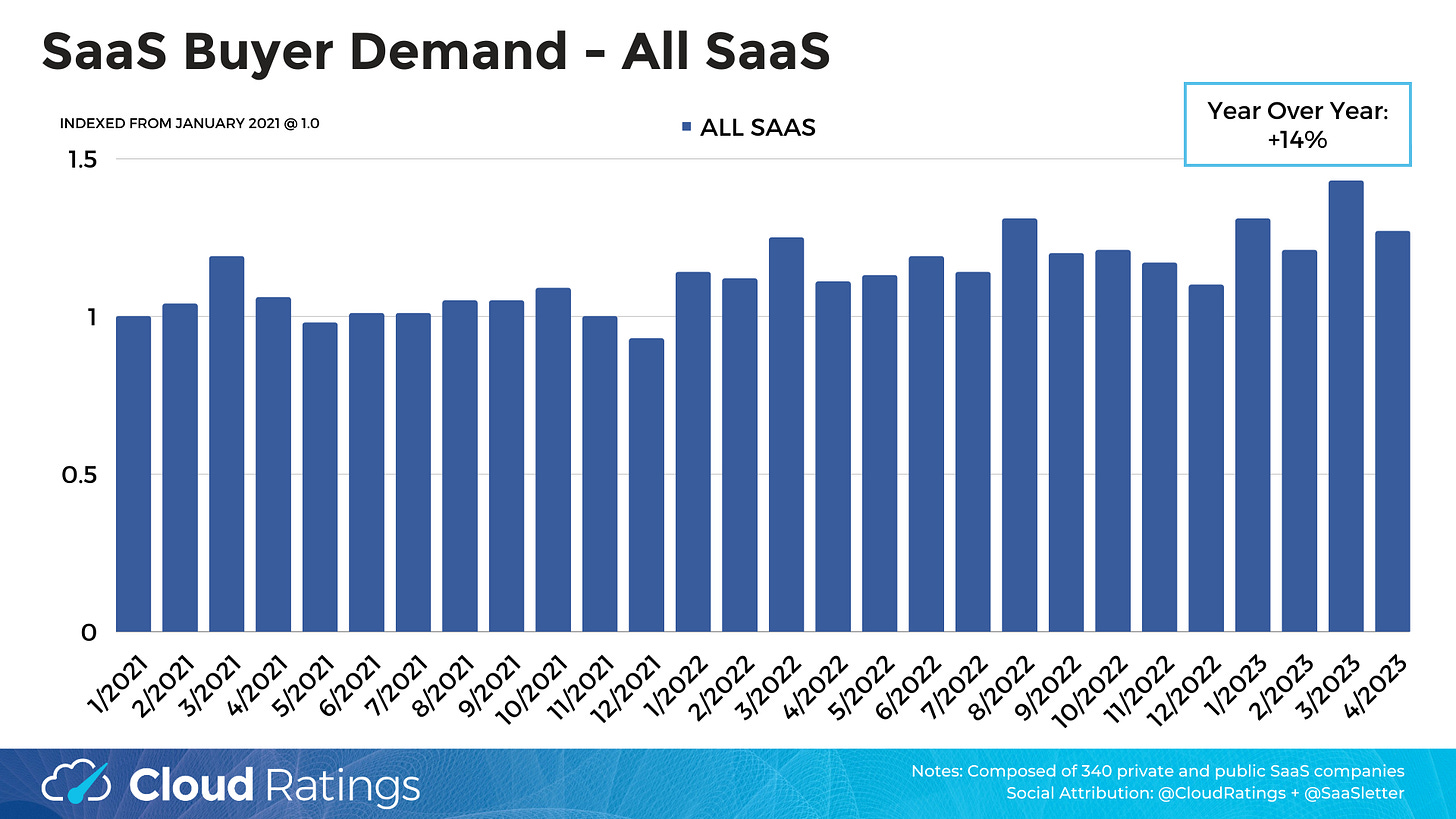

I’m excited to update the SaaS Demand Index with data through April 2023.

For our new readers: the Demand Index is derived from high-intent (aka “okta pricing”) Google Search volume data.

Reminder: this is a directional, free, and ever-evolving analysis → always do your own due diligence.

Moreover, the data captured here is best characterized as top-of-funnel or dark funnel → factoring in sales cycle length, do NOT use this Demand Index as a predictor of near-term financial results and/or financial guidance.

Industry-Wide Data

While high-intent search volumes are up 14% year over year, April Demand was 11% below the March 2023 spike and even below January 2023.

We note that seasonality is a possible factor - perhaps family spring vacations? - given April trends in prior years.

Given the correlations and small differences, presenting the above without comment.

Trends By Product Category

Consensus narratives yet again hold - “Security = strong” and “E-Commerce + Marketing = weak” like past reports (March 2023, Feb 2023, Jan 2023, Dec 2022):

All of the category drill-downs - like this Sales example - are available in this slide PDF:

Other Indicators - Gartner + RepVue + + Scale:

Gartner’s Digital Markets segment revenue growth is another indicator I’m watching since it captures both buyer interest (i.e. traffic on sites like Capterra) and software vendor spend (i.e. their cost per click bids + budgets on Capterra):

Worst quarter since COVID, down 3.6% YoY

38% deceleration from peak growth

RepVue’s April 2023 quota attainment data showed signs of stability. That said, Strategic Accounts and forward indicators (SDRs and Sales Engineers) were weak. Full details threaded on Twitter or on the “Salaries” menu dropdown on RepVue.com.

Lastly, Scale Venture Partners Flash Update highlighted poor plan attainment levels in Q1 2023. Much more in their full report.

Curated SaaS Content

Dave Yuan + Tidemark have some great content on going multi-product here.

Arda Capital / Tidal Wave had a great piece on Gitlab + AI.

…and lots of slides from Scott Brinker (@chiefmartec) on MarTech Sprawl (11,000 apps!)

Cloud Ratings Updates

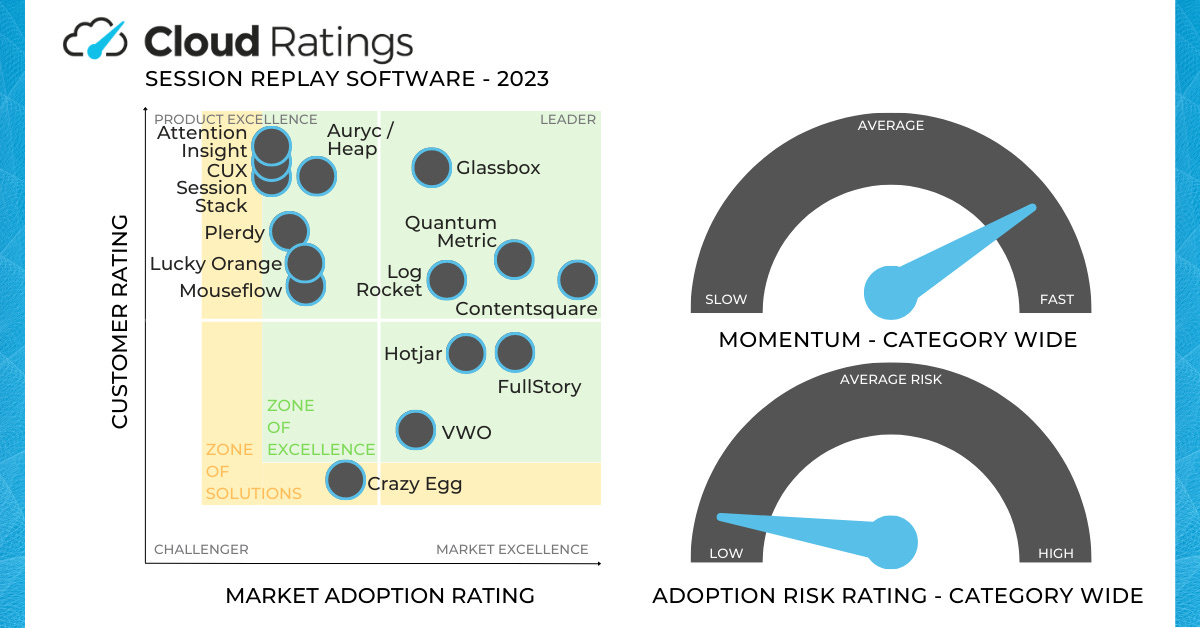

We continue to initiate research coverage of GTM software categories - like Session Replay Software - while podcasting:

“What A Unicorn Knows” - a mini-episode with Pablo Dominguez and Matthew E. May of Insight Partners covering their excellent new book

Our Nick Franklin (Founder + CEO of ChartMogul) episode debuts next week

Solid article and great data. What's particularly interesting is the enterprise sales data. It shows that MM is a good place to be as a seller today.

The Tidemark article, specifically longview part I, is fascinating. You see most sellers looking to break into industries like cloud/security but if you follow the longview perspective (ie FTW, SST, DED, FTW) and understand those mechanics - its ripe for hungry sellers to take advantage of different verticals where talent isn't saturated (ie marketing or procurement).