SaaSletter - Best Content Of 2H 2024

Curating the best of Software x AI for Operators and Investors

Working in generally reverse chronological order, here are our picks for the best software content of 2H 2024:

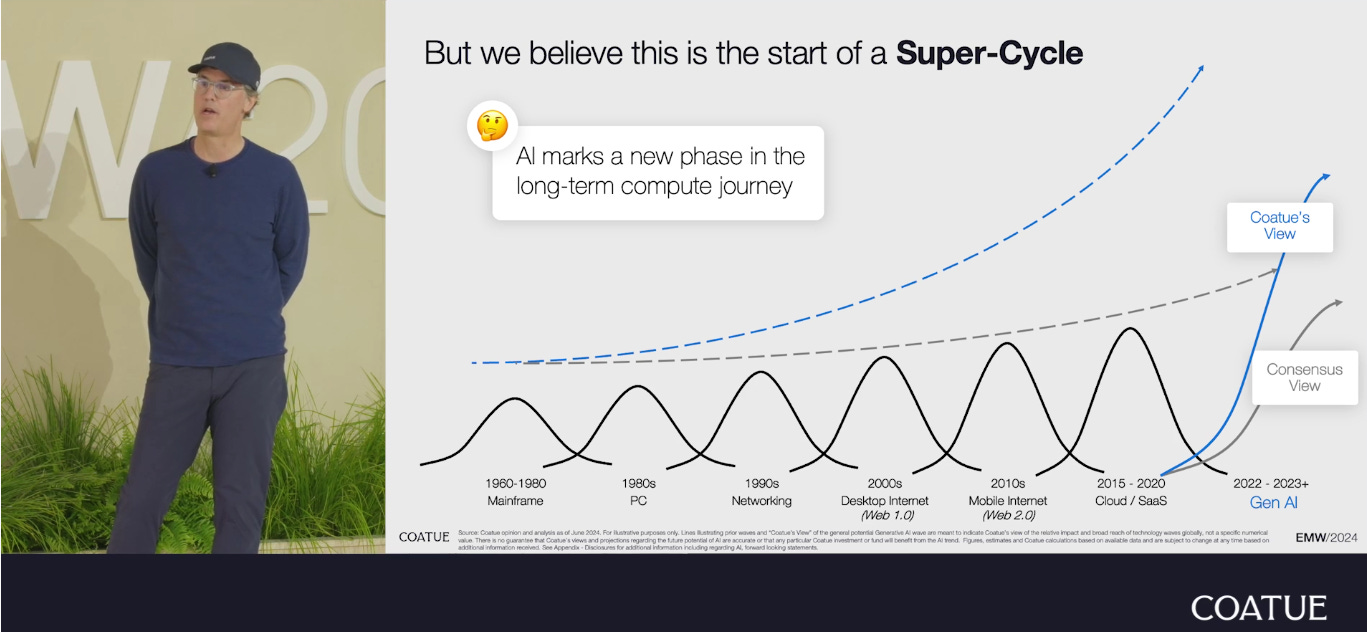

Coatue + their 2024 EMW (East Meets Wests) conference. Slides + video here. My notes here.

“Avenir x SaaS: What’s Gone Wrong In Software And Why We’re Optimistic” - 45-slides from Jared Sleeper, Hannah Bao, and David Prilutsky. More excerpts + takes here.

Ebsta + Pavilion’s H1 2024 B2B Sales Benchmark report update (covers $57 billion of revenue across 4.7 million opportunities, h/t Guy Rubin) merited its own SaaSletter edition.

Pavilion’s Q2 2024 Pavilion Pulse Report (from Josh Carter + team) inspired our “Messy Middle” deep dive on growth challenges in the $25m-$50m-$100m ARR zone, with guest commentary from Edward Robson (his LinkedIn + Twitter), Founder + CIO of emerging manager 2717 Partners:

Sydney Sloan’s (CMO of G2) presentation at SaaStr 2024 inspired our “FOMU: Fear Of Messing Up” note:

ChartMogul’s (h/t Sofia Faustino) “The New Normal For SaaS”: “Net Revenue Retention trends and benchmarks from studying over 2,500 SaaS businesses”

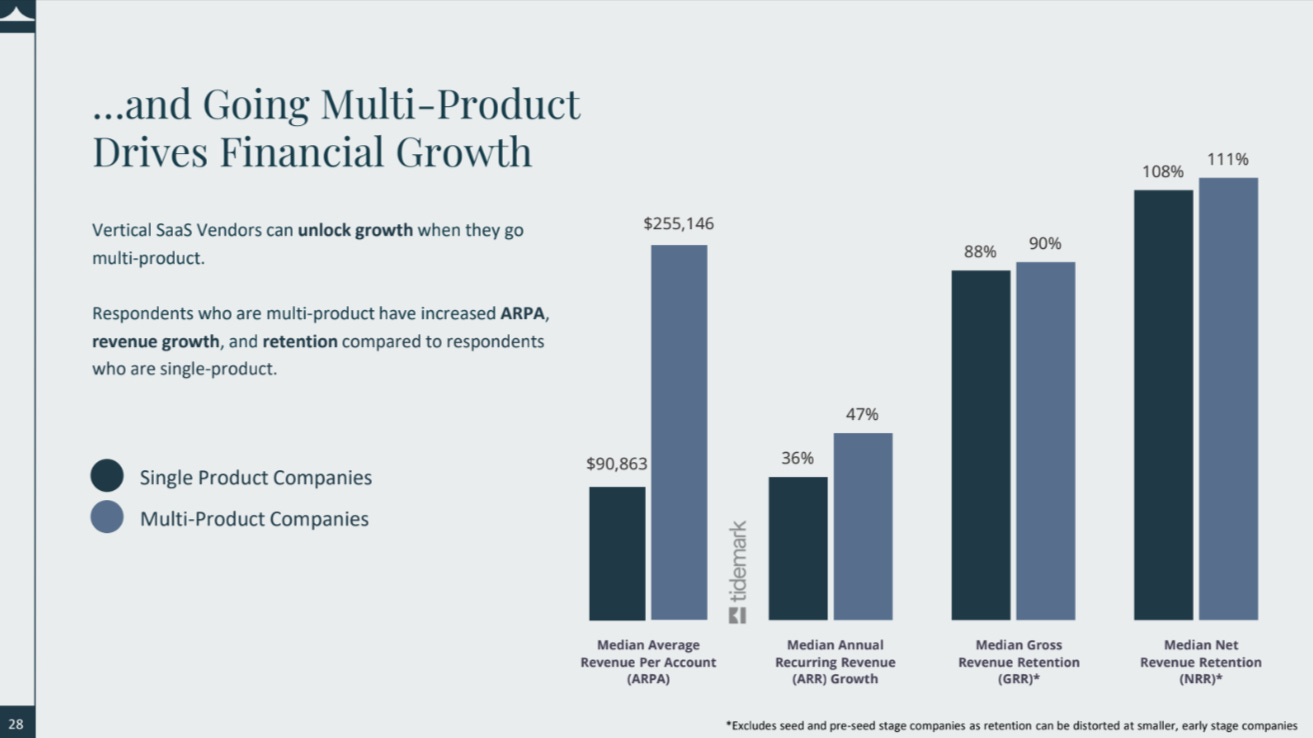

Dave Yuan and the Tidemark team released their debut Vertical SaaS Benchmark report (n = 247 vSaaS vendors). My Tidemark report notes, along with an earlier podcast with Dave Yuan:

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

ICONIQ Growth's (h/t Christine Edmonds + team) excellent "The State of Go-to-Market in 2024" (38 slides, n = 150 vendors).

BVP and Forbes (h/t Alex Konrad) announced their Cloud 100 List, including their “Cloud 100 Benchmarks” report. My notes here.

Sapphire Ventures (h/t Steve Abbott + team) released a mid-year update of their “State of the SaaS Capital Markets” (20 slides). My notes here.

Another ICONIQ Growth report: “Scaling SaaS” (71 slides). My notes here.

KeyBanc Capital Markets and Sapphire Ventures released the *15th* edition of their SaaS benchmarks (email required).

Related Reading: As someone who has been reading their reports for the past 15 years - back to Pacific Crest Securities days (h/t David Spitz) - I created an aggregation of old reports to provide longitudinal context available here:

Alex Clayton and Meritech Capital published 44 slides from their 2024 Annual Meeting.

Battery Ventures (h/t Dharmesh Thakker, Danel Dayan, Sudhee Chilappagari, and team) published their 43 slides from OpenCloud 2024. My OpenCloud 2024 notes here.

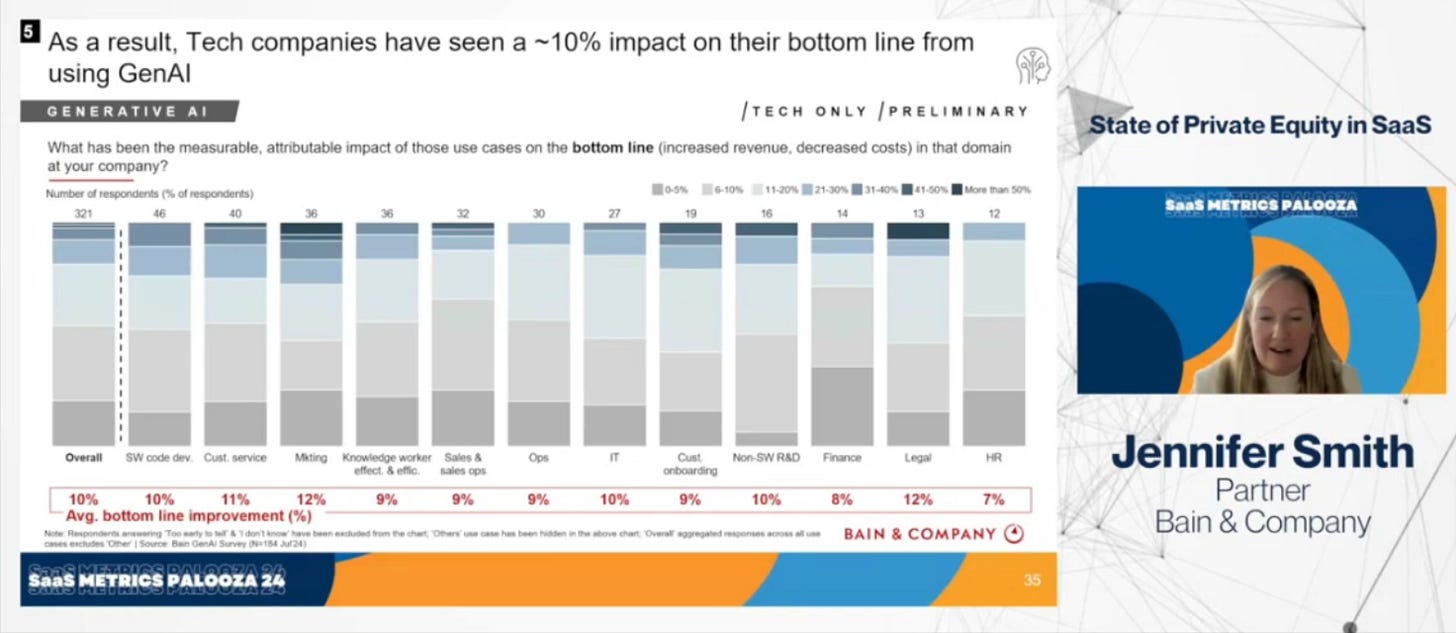

I spoke at Benchmarkit’s “2024 SaaS Metrics Palooza” (thanks Ray Rike) - my slides here:

Building on OpenView Ventures’ benchmark history, High Alpha released its 2024 SaaS Benchmarks report (n=800, mainly in the $0-$20m ARR range).

AI-Centric Content

NEW CURATION: Avenir and David Prilutsky released their “Avenir x AI” industry thesis (52 slides):

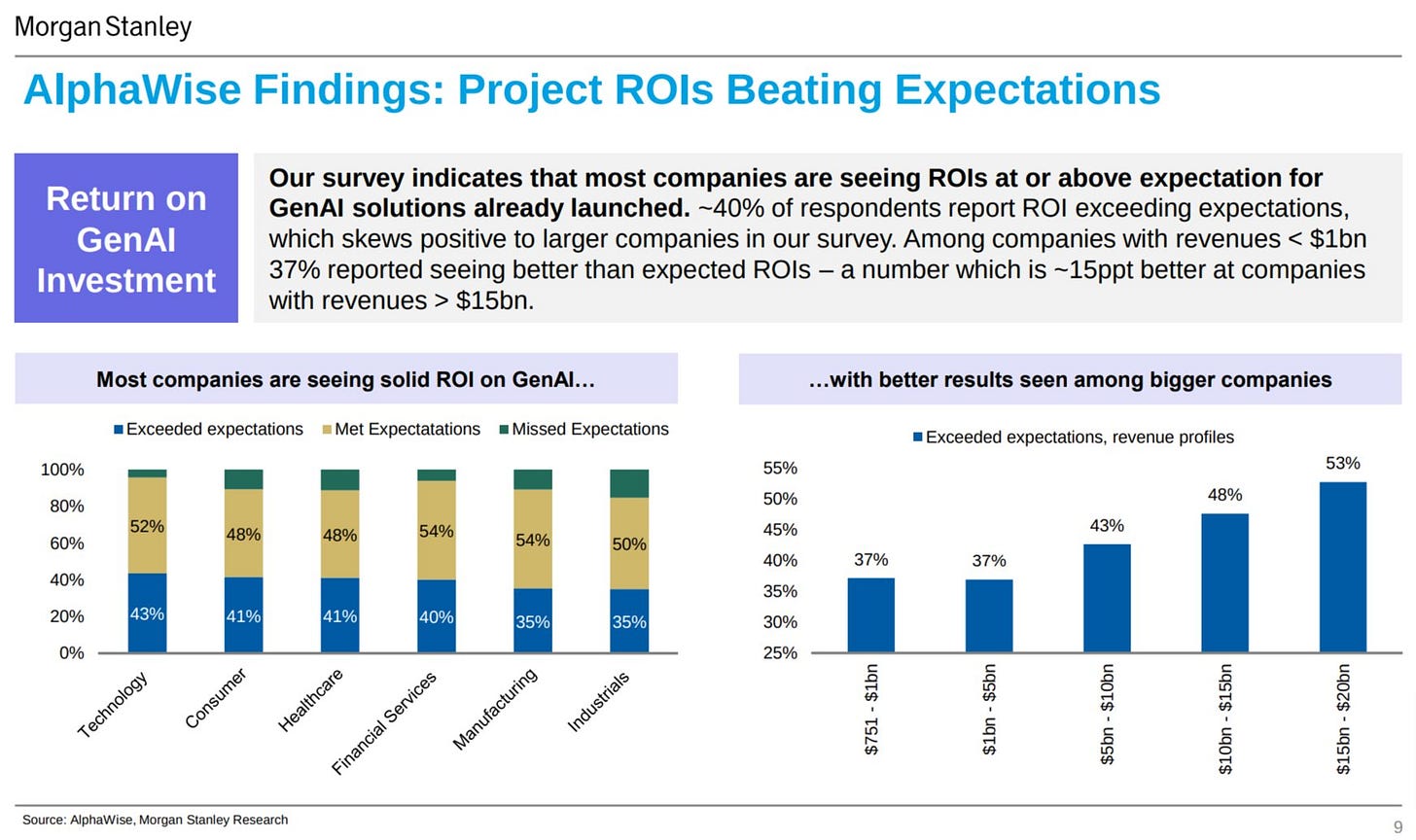

AI ROI surveys have generally been strong in 2H 2024. Our coverage of Morgan Stanley, ICONIQ Growth, and Bain reports here, with key charts below:

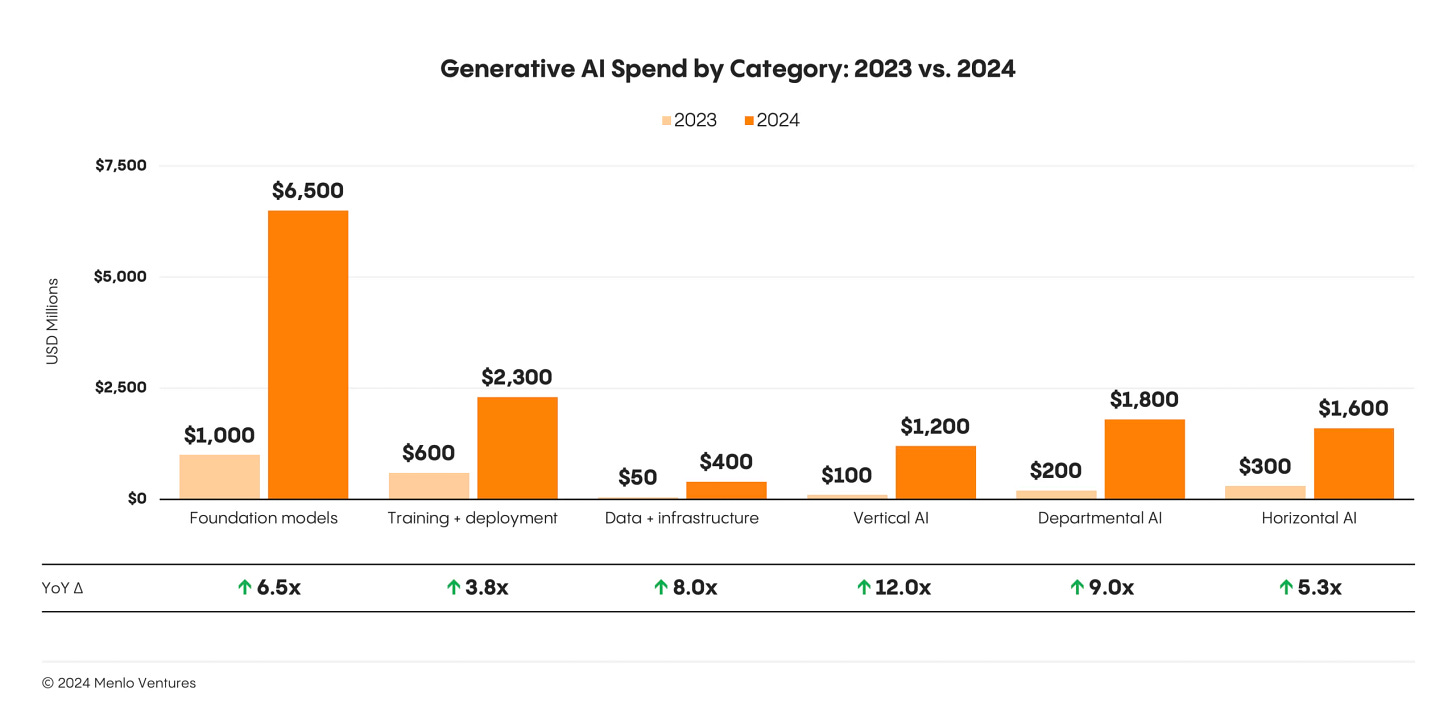

Menlo Ventures (h/t Tim Tully, Joff Redfern, Derek Xiao) released their “2024: The State of Generative AI in the Enterprise” report (n=600 IT decision makers with 50+ employees).

Building on their 152-page(!) vertical AI framework report (email required), we released our AI-centric episode with Marissa Moore and Taku Murahwi of OMERS Ventures:

VIDEO | AUDIO: Apple Podcasts | Spotify | All Platforms

Tactical Operator Content

Kyle Norton’s (CRO of Owner.com) presentation “Secrets to scaling high efficiency outbound” (54 slides):

“The Transaction” Podcast

Craig Rosenberg and Matt Amundson were gracious to invite me on their excellent podcast:

VIDEO | AUDIO | “THE TRANSACTION” SUBSTACK

About Cloud Ratings

Mid-year 2024, we announced a research partnership with G2 - more here:

with this slide showing how our G2-enhanced Quadrants (like our recent Sales Compensation Software release), this business of software newsletter you are reading, our podcasts, and our True ROI practice area all fit within our modern analyst firm: